Dominion: Sufficient Direction and Control

The Intermediaries of the Canada-Israel Education Foundation

No employees, no fundraising costs, and no volunteers. The T3010 Information returns for the Canada-Israel Education Foundation (“Canada-Israel”) paint a disturbing portrait. An incorporated charity with no plant or equipment, operating with a corporate address in a warehouse subunit while its mail was being sent to a PO Box. It never even bothered to build a website despite taking in $2.63 million in contributions over six fiscal years.

Yet, the financial statements attached to the T3010 Information Returns from Canada-Israel attempt to portray the charity as a vibrant and active hub of activity, with a remarkable 81% to 97% of annual contributions committed to charitable programs. In total, the charity submitted to the CRA that it spent a $2.43 million of its $2.64 million in total contributions on charitable activities in furtherance of its charitable purpose across its entire lifespan between 2011 and 2016. A paragon of efficiency.

Unfortunately, the complete T3010 Information Returns, and particularly its attached Income Statement, paint a decidedly different picture. The charity does list the bulging totals of monies spent on charitable programs, but any details as to how are a mystery. There is little of anything on the returns’ expense lines for fundraising, office supplies, membership fees, or purchased supplies for charitable activities. There are no volunteers at this charity. Instead, huge totals are listed under the amorphous “Other Expenditure” category.

Most quizzical is the complete lack of expenses in any fiscal year designated for Research grants and scholarships. This is particularly poignant considering that on line C2 of all six available T3010s, Canada-Israel lists some variation of the following statement describing its ongoing programs, and how they relate to the organization’s charitable purpose as described in its governing documents,

The organization is dedicated to advancing education and understanding about the nature of the Canada-Israel bilateral relationship; historically and its contemporary dimensions. This is accomplished through research, interviews and programs with primary sources in Israel and Canada, participation in seminars and conferences focusing on the bilateral relationship and the context in which these relationships merged/grew.

This organization, dedicated as it was to the advancement of education about the bilateral relationship between Canada and Israel through research and programs, spent exactly nothing from its $2.43 million in expenditures on charitable activities for research grants.

The expenses listed in the Other Expenditures category must have a destination elsewhere on the information returns, and so it is at Canada-Israel. They can be found on the attached Schedule 2 of every T3010 listing the charity’s Foreign expenditures; 85% of all contributions into the charity flow through this schedule. Every dollar listed is expended in either the United States or Israel.

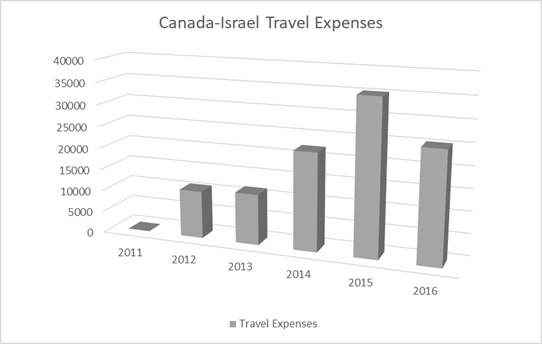

The overseas expenditures begin in fiscal 2011, the first year of operation at the charity, with a foreign expenditure of $170,000 before increasing to $546,992 in 2012. Annual foreign expenditures then peak in fiscal 2015 at $691,833 before declining back to $173,831.

In the first fiscal year, and a portion of the second fiscal year, the charity indicates on its information return that foreign expenditures were made directly by employees, officers, or directors of the charity. The total amount in these two years spent by the charity itself was $476,992.

There are problems with the admission by the charity. The T3010 requires that the charity disclose whether any volunteers or employees of the charity were involved in any way in its foreign activities. These questions are all answered negatively. No employee or volunteer was involved. Which leaves only the three available directors to expend nearly half a million dollars. But there’s a second major problem; travel expenses. In 2011, Canada-Israel submitted to the CRA that they had none. Zip, zilch, zero. The charity would begin submitting a small smattering of travel expenses in every subsequent T3010, but none in 2011.

Which means Canada-Israel told the CRA that without any employees or volunteers or contractors or agents, the three members of the charity’s board of directors managed to expend $170,000 in Israel themselves without actually traveling there. Which is impossible. A stunning lie on an Information Return submitted to the CRA.

This “arrangement” seeped into the second fiscal year when the directors at Canada-Israel, all employed elsewhere at full-time jobs in Canada, had the chutzpah to submit to the CRA that they managed to expend $306,992 in Israel. At least this time there are $10,929 in travel expenses to justify a roundtrip flight.

In the second year of operation, fiscal 2012, the charity does however affirmatively to the question on line 210 of the T3010 return,

Were any of the charity’s financial resources spent on programs outside of Canada under any kind of arrangement including a contract, agency agreement, or joint venture to any other individual or organization (excluding gifts to qualified donees)

Canada-Israel will answer affirmatively to this question on every subsequent available return. This is the charity indicating the use of intermediaries to conduct its charitable activities; those third-party organizations that a charity may legally employ to in furtherance of its own charitable purposes, but legal only when they maintain sufficient “direction and control” over all resources deployed. From fiscal 2013 onwards all foreign expenditures are made through intermediaries and almost all expenditures on charitable programs.

This again creates yet another major issue. Virtually all charitable programs were undertaken by these third-party intermediaries from 2013 onwards. Yet Canada-Israel’s travel expenses increased, despite the directors effectively stating they no longer undertook any major charitable activity themselves and instead used foreign agents exclusively.

This again calls into question the travel expenditures. For example, Canada-Israel submitted to the CRA that the charity expended $11,615 on travel expenses in fiscal 2013, but only had $3,500 in any charitable activity of any kind not completed by a third-party foreign agent.

The directors flew somewhere and then didn’t do anything. Where the hell were they going and why?

The author has an idea as to why the charity has submitted questionable information to the CRA or even outright lies. The CRA takes the maintenance of sufficient direction and control over intermediaries by a charity very seriously; failure to maintain sufficient direction and control can risk a charity’s charitable status. Therefore, CRA guidance recommends that charities planning to use substantial amounts of their contributions on intermediaries submit their agency agreements with their initial application for charitable registration to the agency for preapproval. Simply put, the agreements are usually with the application.

Except, it could be possible for a charity planning to use intermediaries illegally to forgo submitting agency agreements with their application before waiting a fiscal year or two before beginning listing intermediaries in full.

The author found it surprisingly difficult to verify. The CRA has thus far not fulfilled the author’s informal request for the Application for Registered Charitable Status from Canada-Israel, despite it being made three months ago. Funny that. Canada-Israel director Stephen Victor was also asked directly by the author whether intermediary agreements were submitted with the application for charitable registration given their subsequent heavy use. He declined to answer the author’s inquiry.

The next major issue with Canada-Israel’s intermediary usage is their “jumbled” nature on the T3010s. It is standard practice to enter one intermediary per line on an Information Return to clearly indicate what funds were dedicated to what intermediary. Canada-Israel instead chose to jam multiple intermediaries on the same individual lines of the T3010 with a combined dollar value. For example, one dollar value is listed for no less than 5 intermediaries on one line of the T3010 in fiscal 2015. These include the charitable foundation charged with collecting funds for a Jerusalem hospital (The Association of Friends of Sourasky Medical Center), a travel company associated with American Express (Histour Eltiv Ltd), an NGO dedicated to exposing other NGOs operating against Israeli interests in that country’s conflict with the Palestinians, and one of Gerald Schwartz’ direct employees who is also a former media advisor to Israeli Prime Minister Benjamin Netanyahu.

It is very difficult to understand what sort of agency agreement could possibly include these intermediaries with extremely conflicting capacities and missions together into a coherent project.

In another instance, two intermediaries which appear to be located in separate countries (The Friends of Israel Initiative in the United States and Shalem Center in Israel) are both listed in one country — Israel. That’s impossible.

In the author’s opinion, the charity submitted their intermediaries in this fashion not because that was how they were deployed, but because it obfuscates how they were. The jumble does muddle the process of identifying how Canada-Israel was deploying these intermediaries, especially with its obstinate directors unwilling to assist the author in clearing things up. But it doesn’t stop verification. There are still several lines where one intermediary is used, and these lines can be verified. Moreover, with a couple of little tricks, quite a bit can be learned about the operations of the Canada-Israel Education Foundation.

There are seventeen individuals and organizations listed as foreign intermediaries clustered into twelve transactions from fiscal 2012 until fiscal 2016. They appear a cluttered mess jammed sometimes five to a line across the various T3010s filled in by Canada-Israel. To unwind them, the author will begin by examining the dominant intermediary of greatest interest, the Friends of Israel Initiative (“Friends of Israel”). Tax returns which have been obtained from this organization will be used alongside verifiable public disclosures by this charity will be used to complete the analysis.

Then, the author will begin examining the evidence for a number of the smaller intermediaries surrounding the Friends of Israel. Here, evidence from direct communications from executives involved with or with knowledge of these intermediaries will be examined, as well as tax return data, and disclosures made public where available.

Conduits

To help inform the analysis it is necessary to begin by explaining Canada-Israel’s obligations while deploying these intermediaries. These are not organizations that can simply be handed large sums. If that occurs, Canada-Israel has acted as a conduit.

Conduits are a legal construct, generally deployed as a kind of tax shelter, very familiar to charitable lawyers and government auditors alike. Canada Revenue Agency (CRA) Guidance defines a conduit as, “an organization [charity] that accepts donations for which it typically issues tax-deductible receipts and then funnels the money, without maintaining direction and control, to a non-qualified donee.” Conduits are the middle-man in a flow-through which relies on the legal art of charities; they take donations from individuals or other registered charities and illegally forward the funds to organizations outside of Canada otherwise unqualified to received those payments. The donors into the conduit benefit by getting tax forgiveness, the donation receipt, when none is warranted. That’s tax sheltering 101.

Conduits misuse intermediaries to make the technique work. Intermediaries can certainly be used legally to complete a charity’s activities, but only where the charity maintains sufficient ‘direction and control’ over the resources utilized by these organizations or agents. Merely gifting money to a non-qualified donee (which includes almost every organization outside of Canada) will almost certainly cause the CRA to deem the offending charity a conduit.

Of course, maintaining direction and control is a bar far higher than simply naked illegal payments to dubious organizations overseas. The CRA will examine a number of different factors to evaluate whether sufficient direction and control have been maintained, and each situation is unique. For example, a CRA auditor will question whether an intermediary even has the capacity to be deployed in furtherance of a charity’s purpose — a third-party organization focused on poverty reduction in Ghana would likely be a very inappropriate intermediary for a Canadian conservation charity whose charitable purpose focuses on preserving marshland ecosystems. CRA auditors will also check whether the charity has a written agreement with the intermediary, whether the intermediary is being appropriately monitored by the charity, whether ongoing instructions are given by the charity, and ensure that funds between the two are not co-mingling. The resources deployed through the intermediary must be used for the charitable objects of the charity and not for the unrelated purposes of the intermediary. The intermediary must act in furtherance of the charitable activities of the employing Canadian charity and not their own.

The CRA provides the below example in their own documentation, which is helpful for understanding how they evaluate the use of intermediaries,

A charity is registered to protect the environment. A foreign organization that is not a qualified donee approaches the charity, seeking funding for its activity of preserving the rainforest.

The charity approves of the non-qualified donee’s activity, and agrees to provide funding. The two organizations sign a written agreement, and the non-qualified donee commits to use the Canadian charity’s money only for purposes considered charitable in Canada.

However, the charity has no say in where, when, or how the activity is carried out. The charity is simply funding the non-qualified donee’s own activities. Therefore, even though the activity itself is charitable, the charity is acting as a conduit.

If the CRA concludes sufficient direction and control has not been maintained the charity will be deemed a conduit or flow-through, its payments will be deemed illegal, and the agency will very likely revoke its charitable status or levy a heavy fine. This is almost certainly as far as the CRA will go, or need to go, for it is a devastating penalty to an otherwise honest operation. The penalty nullifies the charity as a going concern or penalizes the charity harshly.

If the reader requires additional information on how the CRA evaluates conduits, please click here and here.

The Friends of Israel

The Friends of Israel Initiative Inc (“Friends of Israel”) is the intermediary of primary interest. It was the first intermediary listed by Canada-Israel in fiscal 2012 and the last in 2016. It was involved in more total payments than any other intermediary. Of all funds that are traceable as paid to an intermediary by Canada-Israel, 49.45% involve this charity. Almost exactly half.

The Friends of Israel is the same U.S. based charitable organization former Foreign Affairs Minister of Canada John Baird and former Prime Minister of Canada Stephen Harper both joined almost immediately after resigning from public office in 2015 and 2016.

The Friends of Israel’s U.S. tax returns were obtained, as were all of its public disclosures. The author will be presenting a 50-page audit of this organization for download in the final section of the Dominion. At this time, it is necessary to again remind the reader that this charity is an empty shell, with very little in operations over many years. Certainly not enough to justify the size of the expenses ($10 million) nor its revenue ($12 million). Its public disclosures indicate it has done little more than holding a few meetings gathering several recently retired high-level politicians together.

For now, the focus is not on this charity, but on whether Canada-Israel’s deployment maintained sufficient direction and control over this intermediary. No assistance on the answer to the question was provided by Canada-Israel director Stephen Victor during the author’s conversations with him. No response was received on this issue from Canada-Israel’s email address. Therefore, if there is evidence that sufficient direction and control was not maintained, it will have to be obtained from the tax returns and public disclosures from the Friends of Israel itself.

There are four payments to the Friends of Israel by Canada-Israel in total. Two are combined with additional organizations — The Lawfare Project and Shalem Center. This complicates the analysis. The author will, therefore, be dealing with these two payments during the audit of the Friends of Israel. At this time, the focus will remain only on the two naked payments, entered on Canada-Israel’s T3010 without an additional organization listed with it, in particular, the first payment. It should, however, be noted by the reader that the following analysis applies to every payment from Canada-Israel, at least from the standpoint of the Friends of Israel’s tax returns. The Friends of Israel was very consistent on its tax returns across fiscal years. What applies in one fiscal year applies in them all.

Additionally, please note that both Canada-Israel and the Friends of Israel have aligned fiscal-year ends (June 30th). It is thus possible to match declared revenue and expenses between these two organizations perfectly.

The first payment made by Canada-Israel to the Friends of Israel came in fiscal 2012 for $240,000. In that same fiscal year, the Friends of Israel submitted to the IRS on Part VIII of its I990 Charitable Organization Tax Return that it earned $419,315 in total revenue. This single payment represented 57% of all declared revenue by the Friends of Israel in fiscal 2012. All revenue in this fiscal year is declared on the “All other contributions, gifts, grants and similar amounts” line 1f of the I990’s Statement of Revenue.

Intermediary payments are not gifts, contributions or grants. Sufficient direction and control are never maintained with a gift. They also cannot be co-mingled with donations from other sources.

I990 Tax returns also include a Support Schedule for Organization Described in IRC 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi) in Schedule A. This support schedule requires American charities to specify the type of support received so the IRS can apply several tests necessary for the charity to pass in order to maintain status as a publicly supported organization. There are several potential options on the schedule for entering payments to complete the IRS Assessment. In the case of the Friends of Israel, the charity indicated that all revenue was earned on Line 1: Gifts, grants, contributions and membership fees (Do not include any “unusual grants”).

Only $250 is declared by the Friends of Israel in the Other Income category on Line 10 of this support schedule. This is not nearly a large enough total to encapsulate the intermediary payments. On Line 9, the Friends of Israel was required to declare revenue from unrelated business activities, whether or not they are regularly conducted. This appears to be the appropriate line on the I990 to declare the payments from Canada-Israel. The Friends of Israel is not a qualified donee, instead, it shares far more in common with a contractor or joint venture partner in this relationship. This line is left blank on every available tax return.

If the Friends of Israel declared the intermediary payments from Canada-Israel honestly on their tax returns, they believed Canada-Israel was acting as a donor or in a similar capacity. Which organization made the misstatement and whatever the reason, the tax returns themselves are clear on this point. The Friends of Israel submitted to the IRS that sufficient direction and control were not maintained by Canada-Israel.

Additionally, no Schedule R is included on any of the submitted tax returns from the Friends of Israel to the IRS. Schedule R is used to describe Unrelated Partnerships, including joint ventures. Given Canada-Israel’s statements on its information returns that hundreds of thousands of dollars were expended using the Friends of Israel as an intermediary, it appears very suspect that no Schedule R was ever submitted by the Friends of Israel outlining any details of this relationship, especially in fiscal 2012 when 57% of all revenue was obtained from Canada-Israel. There is no evidence of the Friends of Israel’s relationship with Canada-Israel on any tax return.

A note must be made here on the accounting method used by the charities. According to the Friends of Israel’s tax returns, the Friends of Israel uses the accrual method. This could, in some instances, effect when revenue is declared. However, Canada-Israel also uses the accrual method of accounting. There is no significant difference in the rules between the two countries that the author is aware of which would affect when the expenses were claimed by Canada-Israel on its T3010 and the revenue was claimed on the tax returns from the Friends of Israel. They should match up, in this case, one for one. That does not mean that there is not an esoteric rule of which the author is unaware of. Nevertheless, the author is adamant obtuse intra-jurisdictional accounting regulations should be a matter for the Royal Commission to investigate, and not prevent public disclosure of this important information.

There is corroborating evidence from both the tax returns and the public disclosures from the Friends of Israel that direction and control were not maintained by Canada-Israel. American charities are required to disclose their program service accomplishment’s for the fiscal year on Line 4a of Part III. The Friends of Israel disclosed,

“The organization created and disseminated various working papers and other materials in furtherance of its primary purpose”

All working papers created during this fiscal year are available through the Friends of Israel’s website and were reviewed by the author. Canada-Israel’s charitable purpose is the education of historical and contemporary dimensions of Canada and Israel’s bilateral relationship. Not a single working paper created in fiscal 2012 has any reference whatsoever to Canada or its relationship to Israel.

There is also a detailed event log available on the Friends of Israel website. This event log lists activities undertaken by the charity during the fiscal year. Not a single event in the log lists Canada as a topic or occurred in Canada during the fiscal year of 2012, or any fiscal year.

The event log and materials released by the Friends of Israel from the relevant fiscal period do, however, clearly document the participation of a director from the board of directors of Canada-Israel at an event organized by the Friends of Israel. Unsurprisingly, it is Moshe Ronen, the director who was directly employed by Gerald Schwartz in a different capacity during this time period.

Moshe is directly listed on the Friends of Israel’s website participating in the September 5th, 2011 Friends of Israel meeting at the British House of Commons. He is also pictured (far right) at a table at the event in material released by the charitable organization with a Friends of Israel logo clearly in the background.

The topic for the meeting is listed by the Friends of Israel as “ Palestinian Statehood and the September UN Gambit: A Recipe for Conflict or Consensus?” According to materials released by the Friends of Israel, then Executive Chairman for the Friends of Israel Jose Maria Aznar organized the event to discuss the implications of the Unilateral Declaration of a Palestinian State by the UN. In a speech given to a small audience at a room adjacent to the British House of Commons he emphasized his own conviction that although the declaration by the UN would have some consequences, they would not be “as dramatic as some think”

Two working papers were produced from discussions at the event, “The Palestinian Unilateralist Course and the Responsibility of the International Community” and “No Path to Peace: The Potential Consequences of Palestinian Unilateral Actions at the United Nations General Assembly”. Both papers deal exclusively with the UN’s obligations given the potentiality of PLO Leader Mahmoud Abbas unilaterally declaring a Palestinian state. Specifically, they provide recommendations to EU Members States who are members of the UN General Assembly on how to vote in Israel’s interests if Abbas did declare. Neither paper mentions Canada or references Canada Israeli bilateral relations in any way.

Moshe Ronen was not identified as a board member of Canada-Israel at this event by the Friends of Israel in any material available online. He was instead introduced only as Vice-President of the World Jewish Congress, despite the $240,000 payment made by Canada-Israel made during the relevant fiscal year.

Beyond the Friends of Israel, the author has identified major issues across the remaining intermediary payments. To review, Canada-Israel had a clear dichotomy in how it distributed payments to intermediaries. Half the intermediary transactions, including the first and last, involved the Friends of Israel and half involved a set of fifteen additional intermediaries. The author immediately suspected that this was intentional, and the intention was to obscure the dominant role of the Friends of Israel. He is also of the opinion that there was the potential for additional funds to be redirected back to the Friends of Israel by some of the deployed agents, while others were simply opportunistic donations made by the directors at Canada-Israel to certain organizations.

To highlight these issues, the author will organize the analysis between primary and secondary issues. Serious issues are those transactions where a major potential conflict of interest has been identified or direct written evidence or other strong evidence is available to corroborate that direction and control has not been maintained. Secondary issues are still serious, especially the weight of considering them all together, but have somewhat more remaining questions surrounding the payments and potential for a reasonable secondary explanation. In total, 71% of all traceable intermediary payment volume (including the Friends of Israel) is in the author’s serious category and 82% in the serious or secondary category. Only in 18% of the payment volume was the author unable to obtain some evidence that sufficient direction and control was not maintained by Canada-Israel. No evidence was identified that sufficient direction and control was maintained.

Serious Issues

Aviv Bushinsky is listed as an agent (fiscal 2015 — $327,629). Trained as a journalist, Aviv is the former trusted media advisor to Israeli Prime Minister Benjamin Netanyahu during his first government in the 1990s, and then later acted in the capacity of Chief of Staff to the Minister of Finance for Netanyahu when the latter man led that Israeli government ministry in 2004.

According to the Jerusalem Post, from 2005 onwards, Aviv Bushinsky was employed by Gerald Schwartz and linked directly to Canada-Israel director and Schwartz employee Moshe Ronen who ran the connected Toronto office for the billionaire,

Reisman credits Moshe Ronen, vice president of the World Jewish Congress, and a former president of the Canadian Jewish Congress, for ramping up their commitment to Israel when he brought them into the country on a first-class whirlwind tour…For the past several years, Ronen has quietly brought Canada’s power elite to Israel, believing that the best way to understand Israel is to see the country itself. Schwartz participated in one such mission in June 2004, and was followed by Reisman six months later. Since then, boosting Ronen’s organized trips has become a major focus for Schwartz and Reisman. Ronen has become the managing director of the couple’s burgeoning Israeli affairs office in Toronto, while Aviv Bushinsky, a former chief of staff in the office of Binyamin Netanyahu, manages their offices in Tel Aviv.

On December 12th, 2007, both Bushinsky and Ronen were also added as Vice-Presidents and members of the board of directors for the Gerald Schwartz and Heather Reisman Charitable Foundation (source of funds in transaction trail). Ronen was quickly removed in January 2008 while Bushinsky remains as a director at the Schwartz Foundation to this day. Both men remain employed by Gerald Schwartz and both are identifiable on the website for the Gerald Schwartz founded and managed charity which funds educational opportunities for former Israel Defence Force “Lone Soldiers”, HESEG.

This is a major conflict of interest. As already described in detail, Moshe Ronen is the President of Canada-Israel and one of only three members of the charity’s board while being concurrently employed by Gerald Schwartz who provided 85% of all contributions into Canada-Israel. Canada-Israel then deployed Aviv Bushinsky, his counterpart in Israel for his employment with Gerald Schwartz who was a director at the Schwartz foundation at the time as an intermediary/agent.

For further information, the author would direct the reader to review the previous section (see: Dominion: False Returns) outlining the requirement for Canada-Israel to remain at arm’s length from a major contributor such as Schwartz.

Israel Brain Technologies (link) $50,000 in the fiscal year 2014 (July 1, 2013 — June 30, 2014) According to Israel Brain Technologies’ (IBT) website, the entity is, “a non-profit organization whose mission is to accelerate the commercialization of Israel’s brain-related innovation and establish Israel as a leading international brain technology hub” It operates a popular conference, BrainTech, to foster connections in the neuroscience industry in Israel and offers industry participants an online social networking tool. Founded through the efforts of former Israeli Prime Minister Shimon Peres to promote the work of Israeli scientists, IBT is a legitimate non-profit operating in good standings with Israel authorities. The conduct of those directing the activities at Canada-Israel is under scrutiny, IBT is not.

Though IBT is an institution of integrity, its mission statement and list of activities do not align with the charitable purpose or activities listed on Canada-Israel’s T3010 Description of Ongoing Programs during the relevant fiscal year. This will be reproduced below, and the reader should notice that the statement from the T3010 in no way relates to “Neuroscience”,

The organization is dedicated to advancing education and understanding abut the nature of the Canada-Israel bilateral relationship; historically and its contemporary dimensions. This is accomplished through research, interviews and programs with primary sources in Israel and Canada, participation in seminars and conferences focusing on the bilateral relationship and the context in which these relationships emerged/grew.

Such an incongruence naturally creates serious questions as to what, exactly, is going on here. An answer to that could only come from IBT itself, and fortunately, IBT’s Executive Director Miri Polachek was willing to answer a few questions about this donation. Miri confirmed to the author via email that the organization understood the intermediary payment as a donation and that the organization “did not do any work for them”. Miri wrote, “If I remember correctly it was made for our first Braintech Conference”.

The Braintech Conference is organized to bring together various stakeholders in the neuroscience and brain technology industries in Israel with participants from the international community. According to its website,

BrainTech has established itself as a leading global meeting place for the neuro-innovation community. It presents a unique opportunity to connect and learn about the latest developments in brain research and brain technologies, engage with leading researchers, clinicians and industry executives, meet braintech startups, and participate in unparalleled discussions and networking opportunities, all geared towards fostering new collaborations.

The Federal Court of Appeal has rendered three decisions ( The Canadian Committee for the Tel Aviv Foundation, Canadian Magen David Adom for Israel, Bayit Lepletot) concerning charities using intermediaries to carry out foreign activities. In all cases, the Federal court has confirmed that a charity must control the activities carried out on its behalf by the intermediary, and over the use of its resources. The email communication from the IBT executive indicates that Canada-Israel made the payment as a donation; a payment where control was not maintained and no work was completed in furtherance of the charitable purpose of Canada-Israel. If Miri Polachek’s communications are honest, and there is no reason to believe that they are not, Canada-Israel funneled money overseas illegally. It acted as a conduit.

Moreover, IBT appears, in this author’s opinion, to lack the capacity to properly conduct the listed programs on Canada-Israel’s T3010 for 2014. Promotion of Israeli neuroscience companies is a noble pursuit, however, it appears very questionably aligned with educating on the historical and contemporary Canada-Israel bilateral relationship.

The Association of the Friends of Sourasky Medical Center (Fiscal 2015) The second executive who responded to the author’s email correspondence was the CEO of the Sourasky Medical Center. This Jerusalem-based Medical Center is Israel’s third largest hospital, and leading acute care facility. The Association of the Friends of Sourasky Medical Center, the listed intermediary in fiscal 2015, is the hospital’s charitable foundation.

In general, a hospital foundation should not be expected to have the capacity to act as an intermediary. Intermediary relationships require the relevant third-party organization to be deployed by a charity in furtherance of its charitable objects. This requires written agreements, schedules of deliverables, constant monitoring by the charity to ensure the work is being completed as agreed upon, and the charities funds to remain unmixed with the general accounts of the third-party organization. Hospital foundations exist largely as passive entities taking unencumbered donations to flow them along into a hospital to pay expenditures. It would appear as though The Association of Friends of Sourasky Medical Center would normally lack the capacity to act as a legal intermediary for a Canadian charity.

The CEO of Sourasky Medical Center confirmed the author’s suspicions. He was explained in detail that, as a listed intermediary, the Sourasky Medical Center’s hospital foundation would be required to work in furtherance of Canada-Israel’s charitable activities and not the hospital’s unrelated, though admittedly admirable, healthcare activities. Writing in an email, he said, “There was not any situation that any amount was paid to the Association of Friends of Sourasky Medical Center and WAS NOT used for the Sourasky Medical Center and its activities. The association is in a direct 1:1 link to the medical center”.

The CEO of the Sourasky Medical Center would appear to be a reliable source. The author is therefore of the opinion this is a second illegal payment.

A Note on the Evidence Presented Thus Far

Two emails confirming that Canada-Israel acted as a conduit from two credible parties have been presented. A member of the Schwartz Foundation has now also been identified among the intermediaries.

The author is compelled to intervene for a moment and explain to the reader that each and every intermediary must be evaluated individually for evidence whether or not Canada-Israel maintained sufficient direction and control. Then, the weight of the evidence must also be considered.

The email evidence is strong. The author would thus ask the reader to consider who is more believable. By listing IBT and Sourasky Medical Centre as intermediaries, Canada-Israel’s directors have claimed that they maintained sufficient direction and control over these organizations as intermediaries. Both the hospital CEO and Executive Director have stated in writing that sufficient direction and control was not maintained by Canada-Israel.

Who is more believable? The three directors and Israeli lobbyists operating Canada-Israel, a charity with no employees, volunteer training, infrastructure or discernable operations? The directors who submitted incorrect Information Returns to the CRA which concealed the Schwartz Foundation contributing the vast bulk of their revenue? A President who employed a director at the Schwartz Foundation as an agent? Moshe Ronen, a Gerald Schwartz employee and director of the charity being paid millions by the Schwartz foundation? Men who refuse to speak in any respect about this charity or these payments?

Or, is the CEO of Israel’s third-largest hospital and the Executive Director of a prominent charity more credible? Two confirmations are better than one.

If you believe the Executive Director and/or Hospital CEO, then Canada-Israel acted as an illegal conduit. It’s that simple.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Secondary Issues

Secondary issues are also serious, however, direct written statements were not obtained from key executives. The author will deal with these issues one by one.

Menifa — Man of L’Chaim & Tech-Careers (Fiscal 2015) Menifa is a Jersulam-based non-profit organization which has established learning centers across Israel working in conjunction with the Israeli Ministry of Education to prevent disadvantaged teenagers from dropping out of high school. During the fiscal year where the intermediary payment is listed, Menifa was running a donation drive in conjunction with the Ministry of Education called L’Chaim. This donation drive involved sponsoring a disadvantaged Israeli youth for entrance into one of Menifa’s Learning Centers. The style of entrance for the intermediary payment on the T3010, specifically noting the L’Chaim donation drive, appears to make it another likely candidate for a donation, this time to sponsor a disadvantaged Israeli youth. Again, this would mean that sufficient direction and control was not maintained.

Tech-Careers is an Israeli NGO founded in 2002 by and for Ethiopian-Israelis listed on the same combined line as Menifa’s donation drive program on the T3010 for fiscal 2015. This NGO’s mission is to train Jewish Ethiopian immigrants to Israel for careers in Israel’s high-tech industries. The charity had trained 550 Ethiopian immigrants in technical skills by 2016, with a 93% hiring placement rate within Israeli technology firms.

Tech-careers appears to be a very weak candidate organization to have the capacity to meaningfully contribute in furtherance of Canada-Israel’s charitable purpose of advancing education on Canada and Israel’s historical bilateral relationship. It’s a laudable charity, certainly, but no-one could reasonably believe Ethiopian tech training has anything to do with Canada-Israel bilateral relations.

Committee for Shomron Residents (Fiscal 2013) It is when the Committee for Shomron Residents (“Shomron Committee”) was investigated that the author’s findings began to take a more sinister turn. It is very difficult to convey in limited space the author’s sense of inappropriateness for a Canadian charity employing this organization as an intermediary. Therefore, it may be best to simply quote the Israeli Defense Force Commander who described the Price Tag policy the Shomron Committee allegedly assists as “Jewish Terrorism”. Given the nature of this organization, the reader is directed to review a report prepared by The Center for the Renewal of Israeli Democracy prepared on the Shomron Committee entitled At Any Price for further information.

The Shomron Committee is a non-profit organization directly funded by the Shomron (Samaria) Regional Council, the Israeli state authority in charge of settlements in the disputed northern West Bank territories. It was founded in 2008 by hard-line right-winger and then-Shomron Council Head Gershon Mesika to act as its “unofficial political arm of the council”. It is currently headed by Benny Katzover.

According to the Center for the Renewal of Israeli Democracy, Gershon Mesika recently became a state witness in a vast corruption trial. At issue at trial was the transfer of money to the Yisrael Beitenu party in exchange for receiving state funding. Mesika’s deputy and acting head of the Shomron Council, Yossi Dagan, also helped found the committee and acted as its spokesperson. His home address at the settlement of Shavey Shomeron is still registered as the official mailing address for the organization.

The report prepared by the Center for the Renewal of Israeli Democracy presents damning evidence for the following two key findings,

The Shomron and Binyamin Residents Committees…first developed the “Price Tag” policy. Their functionaries call for illegal action to delay or prevent security forces from evacuating illegal settlement structures in the West Bank. These nonprofits were formed in order to act in ways that the official regional councils cannot. In a series of publications disseminated among right-wing activists, they called on their communities to carry out “Price Tag” acts and various illegal activities, including rioting and erecting new outposts, in order to deter the IDF from evacuation attempts. They also commended acts such as burning fields and other property and injuring Palestinian civilians. Urging citizens to break the law and encouraging violence constitutes incitement, which is considered a criminal offense under penal law.

And,

The Shomron Committee’s work plan — one of the documents first exposed here — calls on supporters to riot and block roads, attaching maps with detailed directions to locations that will guarantee maximum disturbance of security forces’ work. Disseminating these maps allegedly constitutes accessorial liability

Though evidence has been produced to buttress these allegations, they are, to this date, still allegations. If proven true, obviously promoting attacks against Israeli Defence Forces in Palestinian territories is not a legitimate charitable activity for a Canadian charity to be involved in. Given its public activities, it is therefore very difficult to understand in what capacity the Shomron Committee could have been deployed in furtherance of Canada-Israel’s charitable purpose — Israeli Canadian bilateral relations.

More importantly, the Shomron Committee is active only in the disputed West Bank territories. The courts have held that an organization is not charitable in law if its activities are contrary to public policy. An activity is not contrary to public policy unless there is a definite and officially declared and implemented policy (found in an Act of Parliament, a regulation or other publicly available government document of any kind).

In this case, there is a set of policies. Relevant to Canada-Israel’s deployment of the Shomron Committee as an intermediary is Global Affairs Canada’s official policy entitled “Canadian Policy on Key Issues in the Israeli-Palestinian Conflict”. In part, it reads,

Canada’s policy on Occupied Territories and Settlements

Canada does not recognize permanent Israeli control over territories occupied in 1967 [including the West Bank]. The Fourth Geneva Convention applies in the occupied territories and establishes Israel’s obligations as an occupying power, in particular with respect to the humane treatment of the inhabitants of the occupied territories. As referred to in UN Security Council Resolutions 446 and 465, Israeli settlements in the occupied territories are a violation of the Fourth Geneva Convention. The settlements also constitute a serious obstacle to achieving a comprehensive, just, and last peace.

It is the author’s position that even if direction and control had been maintained by Canada-Israel over the Shomron Committee, if this intermediary was used in the disputed West Bank — where all public evidence indicates it operated exclusively — Canada-Israel’s use of it would serve to encourage and enhance the permanency of the settlements and therefore be contrary to Canada’s public policy on this issue.

A second issue with this intermediary is the absence of any declared political activities on the T3010 returns of Canada-Israel. It is very difficult to understand how a Canadian charity could use an intermediary that was founded ostensibly an “unofficial political arm” for controversial politicians in furtherance of charitable purposes that were not political.

Lawfare Project (Link) The Lawfare Project (“Lawfare”) is a New York City, NY, USA charitable organization registered in the United States. According to its website,

We are a global network of legal professionals that contribute our skills, time and expertise to defending the civil and human rights of the Jewish people and pro-Israel community, and fighting discrimination wherever we see it.

In particular, the organization is dedicated to fighting lawfare, which it defines on its website as,

The Lawfare Project produces research that educates policymakers about the threat of lawfare — the abuse of the law as a weapon of war against western democracies

The Lawfare Project was contacted multiple times regarding the intermediary payments. Brooke Goldstein, the founder of the Lawfare Project, did respond to general inquiries but refused to answer any direct inquiry into the intermediary payment or the Lawfare Project’s relationship to Canada-Israel. Therefore, the analysis of the agency payments was completed using the i990 Charitable Tax Returns submitted by the Lawfare Project to the Internal Revenue Service (IRS) and the organization’s public disclosures through their website.

The Lawfare Project was paid on individual T3010 lines by Canada-Israel in fiscal 2014 for $23,935, and 2016 for $23,611, and on a combined line in fiscal 2015 with the Friends of Israel Initiative for $256,206. Given the size of the additional Friends of Israel Initiative payments relative to the tiny payments to the Lawfare Project, it is reasonable to assume that the vast majority of the funds on the combined line were actually paid to the Friends of Israel Initiative.

According to the Lawfare Project’s i990 tax returns the vast majority of their funding was earned as unencumbered contributions to the charity between fiscal 2014 to fiscal 2016 — $666,013, $345,868, and $1,027,751 respectively. There is also a substantive amount of revenue earned from program services during the same time period; $27,374 in fiscal 2014, $24,227 in fiscal 2015, and $4,660 in fiscal 2016. All other revenue sources listed on the i990 Charitable Organization tax returns are inconsequential given the size of the intermediary payments at issue.

If Lawfare declared the payments from Canada-Israel as unencumbered donations, where the vast bulk of revenue was declared on the tax returns, then, once again, Canada-Israel failed to maintain sufficient direction and control over its resources. The only alternative would have the Canada-Israel payments listed in the Program Services lines of the i990 tax returns. Unfortunately, Program Services Revenue is also inappropriate for an intermediary payment. According to IRS guidance, program services revenue is declarable only where the service performed “furthers the organization’s exempt purpose.” Lawfare lists its program service accomplishments on its i990 tax returns,

To raise awareness about the phenomenon and specific instances of Lawfare, assuming the subject matter received the credibility and immediacy it warrants 2. To facilitate legal and non-legal responses to the perversion and misapplication of international and National Human Rights Law 3. To identify potential lawfare threats and mobilize human and institutional resources to combat them 4. To bring diverse and interested parties together in a common forum to discuss the phenomenon.

This charitable purpose in no way aligns with the charitable purpose — educating on the historical and contemporary dimension of the Canada and Israel bilateral relationship — of Canada-Israel. More importantly, the CRA in the recently publicly released Beth Oloth audit clearly states that “combatting Lawfare” is not a valid charitable purpose for a Canadian charity.

Therefore, unless the tax returns from the Lawfare Project have been incorrectly filed, there appears to be another piece of evidence that Canada-Israel did not deploy an intermediary in furtherance of its charitable purpose and instead used the intermediary for a purpose that was not charitable as defined by the CRA.

If the intermediaries’ communications with the author are to be trusted, it is apparent that Canada-Israel did not maintain sufficient direction and control over several, if not all, of its intermediaries and agents. Moreover, the identity of one additional intermediary adds questions as to whether or not Canada-Israel has contravened Canada’s public policy.

But finding evidence that some of the intermediary payments were illegal donations does not provide information as to how these intermediaries were selected by Canada-Israel in the first. To answer that we must look to the agenda and priorities of the Centre for Israel and Jewish Affairs (CIJA), whose CEO also happened to be Canada-Israel Treasurer and Director Shimon Fogel during the relevant 2011 to 2016 timeframe.

Take, for example, the aforementioned Israel Brain Technologies, listed as an agent in fiscal 2014 (July 1, 2013 — June 30, 2014) with a $50,000 payment. IBT Executive Director Miri Polachek has already confirmed that the organization took the intermediary payment as a donation, ostensibly towards their first BrainTech Conference in 2013.

But access to Israel Brain Technologies for Canada-Israel appears to have been facilitated by this organization’s relationship with CIJA and Surrey, BC mayor Dianne Watts in the late fall of 2013 and early winter of 2014.

In April 2013, Dianne Watts announced the creation of an Innovation Boulevard in Surrey dedicated to medical technology. According to Canadian Jewish News, “the Centre for Israel and Jewish Affairs (CIJA) in the Pacific region immediately started paying attention.”

“When we heard of her intention to create an Innovation Boulevard, we knew the mayor needed to tap into Israel’s spirit of ingenuity,” CIJA Pacific region director Darren Mackoff stated at the time.

CIJA then organized a six-day trade mission to Israel in December 2013 with a delegation that included representatives from Simon Fraser University, UBC, and Kwantlen Polytechnic University, all of whom were stakeholders in the mayor’s new project.

After returning from the trip to Israel, the Surrey Mayor’s first international deal of any kind for the Innovation Boulevard was with Canada-Israel intermediary Israel Brain Technologies. The correct timeframe for both the fiscal year listed and the explanation offered by Ms. Polachek to the author.

Another intermediary used by Canada-Israel not already covered is Shurat Hadin (fiscal 2016). It’s an Israeli non-profit with a very similar mission to the Lawfare Project in the United States, “ We are dedicated to protecting the State of Israel. By defending against lawfare suits, fighting academic and economic boycotts, and challenging those who seek to delegitimize the Jewish State, Shurat HaDin is utilizing court systems around the world to go on the legal offensive against Israel’s enemies.”

It’s very likely another inappropriate intermediary if the work completed by Shurat Hadin with or for Canada-Israel aligned with its mission. As already noted, the CRA has communicated through previous audit judgments that they do not view “defending against lawfare suits” and “protecting the State of Israel” are valid charitable purposes (Beth Oloth Audit).

Shurat Hadin did not respond to the author’s attempts to clarify the issue and so he will leave the above statement as is. What is known is that Canada-Israel’s deployment of Shurat Hadin perfectly aligns with the activities of CIJA during the relevant fiscal year. In November 2015 (fiscal 2016 at Canada-Israel) CIJA funded a “fact-finding” mission for Canadian journalists to Israel. This mission included a presentation by Shurat Hadin Executive Director Nitsana Darshan-Leitner in Jerusalem to promote the organization’s ongoing lawsuit with Facebook on behalf of Israeli victims of jihadist attacks. Journalist Don Peat from the Toronto Sun subsequently published an article vociferously quoting Nitsana for the local Toronto community.

The strangest set of associations between an intermediary and CIJA are with the Schusterman Foundation — Israel. The Schusterman Foundation is a billion dollar private foundation located in the United States run by Lynn Schusterman. The Schusterman Foundation — Israel is an independent charity in Israel wholly reliant on the tens of millions sent to it by the U.S. — based Schusterman Foundation every year.

According to the Schusterman Foundation’s i990 tax returns, the Schusterman Foundation — Israel was established to promote and support ventures and projects that “strengthen the fabric of Israel, including but not limited to projects involved in education, culture, the environment, and religious pluralism”

Lynn Schusterman is also a board member at the American Israel Education Foundation (“American-Israel”), a U.S. charity associated legally to the American Israel Public Affairs Committee (AIPAC), the largest Israeli lobbyist in the United States and the world. The name rings a bell, considering the conduit’s name in under examination is the Canada-Israel Education Foundation. There is some public information regarding the activities of this charity on a one-page website with the following statement,

The American Israel Education Foundation (“AIEF”) is the charitable organization affiliated with AIPAC, America’s pro-Israel lobby, and was created in 1990. AIEF makes annual grants to AIPAC that are consistent with the Foundation’s status as a charitable and educational 501 ©(3) organization, providing grants to support select educational programs including Middle East research, educational materials and conferences, and leadership programs for university students. In addition to making grants for AIPAC programs, the Foundation funds educational seminars to Israel for members of Congress and other political influentials. These AIEF-sponsored trips help educate political leaders and influentials about the importance of the U.S. — Israel relationship through firsthand experiences in Israel, briefings by experts on Middle East affairs, and meetings with Israeli political elite.

American-Israel is openly associated with AIPAC. It is also very large, with total contributions exceeding $256 million within the last five fiscal years where i990 returns are available.

The charitable organization which, in the author’s opinion, acted as a conduit, the Canada-Israel Education Foundation, is named intentionally to appear very similar to the American Israel Education Foundation. Though the actual reasoning behind this choice is known only to those responsible for making the decision, in the author’s opinion, the choice would have certainly opened more than a few unsuspecting doors in the tight-knit Israeli lobbying community. It is very difficult to believe it was not intentional.

Unfortunately, their strangely congruent names are where the similarities end between these two charities. American-Israel is nearly 30 years old, is publicly and clearly associated with a major Israeli lobbyist, has 40 directors and employs 8 named officers. It has compensated employees and a website which properly communicates what the charity does and how it is associated. Canada-Israel has none of these attributes.

All of this is very concerning if Canada-Israel is associated — in fact, if not disclosure — with Canada’ equivalent to AIPAC, the Centre for Israel and Jewish Affairs (CIJA). Especially when CIJA’s CEO Shimon Fogel acted as Canada-Israel’s Treasurer while co-founders of CIJA, billionaire Gerald Schwartz and his wife Heather Reisman, provided the vast majority of the charity’s funds.

The Schusterman Foundation also has an identifiable relationship with CIJA during the relevant time period. The Canadian lobbyist sent employee Dan Hadad-Aviad to the Schusterman Foundation’s 2011 ROI Community Summit and CIJA helped send a delegation of Canadian representatives to the Schusterman Foundation-funded “Eighteen: 22” founding conference for global LGBTQ Jewish leaders and allies in Austria in 2015. So, the Schusterman Foundation was clearly known to CIJA executives, who included Canada-Israel directors Shimon Fogel and Moshe Ronen.

The efforts and objectives of CIJA are a common theme running through the list of intermediaries selected by Canada-Israel to complete its own charitable activities. CIJA’s presence helps to illuminate not only the motivations of the directors in the Schwartz Foundation or the directors guiding the charity but also the smaller support donors contributing to Canada-Israel with Schwartz. As discussed earlier, a small array of additional private foundations were identified that also listed the Canada-Israel Education Foundation on their related T1236 forms. During that discussion, the author revealed how key board members at these private foundations relate personally and professionally to Gerald Schwartz himself. There was also a brief discussion of their involvement with CIJA. Now, with CIJA’s interests apparent in the use of intermediaries, it may make a little more sense why the Frieberg Foundation’s 2016 donation receipt on that foundation’s T1236 was labeled as Canada-Israel Education Program (CIJA). As if CIJA CEO’s role as Treasurer at Canada-Israel was not already a convincing signal.

It might not be surprising then that these smaller donors’ interests themselves appear to make an impact on the selection of intermediaries by Canada-Isreal. To help explain, the author must introduce Danny Eisen. Eisen isn’t an employee of CIJA, but he is affiliated with it, and his brief biography appears on the lobbyist’s website. He’s listed by CIJA as a Toronto-based consultant and co-founder of the Canadian Coalition Against Terror (C-CAT). C-CAT was responsible for organizing pressure on the Harper Government for the passage of the Justice for Victims of Terrorism Act (JVTA) passed into law by Parliament in 2012. The organization, which is not a registered charity, has website listing endorsements from Stephen Harper, Gilles Duceppe, and Michael Ignatieff among others. More recent priorities of this organization include compelling the Canadian Federal Government to list Iran’s Revolutionary Guard as a terrorist entity and sanctioning Iran’s energy interests. The website has not been updated since 2016.

According to the T3010 returns, Danny Eisen was employed by Canada-Israel as an agent in Israel in fiscal 2014. This is surprising because according to C-CAT’s website Eisen was concurrently very active during this time period advocating on behalf of that organization in Canada. There are numerous editorials from major newspapers by Mr. Eisen and Sheryl Saperia listed from the Ottawa Citizen, National Post and Canadian Jewish News from that fiscal year.

Of particular interest is Eisen’s activity in May and June 2014, near the end of the fiscal year (June 30th). At this time C-CAT sponsored a full page ad in the Ottawa Citizen protesting the display of Palestinian-Canadian Rehab Nazzal’s exhibit entitled “Invisible” at Ottawa City Hall. Part of a film that made up the multimedia exhibit portrayed images of what official publicity material described as “assassinated Palestinian figures…lost artists, writers, and leaders” Several of the individuals were members of armed Palestinian groups implicated in terrorist attacks against Israelis, causing a major controversy. Somehow, an art exhibit in a city hall must take our headspace when it involves these two middle-eastern groups half-a-world away.

The Israeli Embassy released a statement, stating the exhibit “reflects a culture of hate and incitement that contradicts the values of Canada as a guardian of peace and champion against terror”. The Israeli Ambassador to Canada personally met with Ottawa Mayor Jim Watson to discuss the exhibit.

Canadian Senator Linda Frum was incensed over the exhibit. Frum is Chairwoman of the board of directors at the Linda Frum and Howard Sokolowski Charitable Foundation, which supported Canada-Israel with a contribution of $5,000 in fiscal 2014. Recall again that according to Canada’s official lobbying registry that 10 of 16 of Linda Frum’s contact with lobbyists involved CIJA. One of these 10 contact points occurred on May 8th, 2014, as the exhibit controversy was about to begin. John Baird was involved in the meeting with Linda Frum and the topic of conversation as per the registry was International Relations.

Frum wrote a commentary, A shameful tribute to terror, masquerading as ‘art’ in Ottawa, for the National Post on June 4th, 2014 on the exhibit, republished on C-CAT’s website next to a link to the advertisement C-CAT placed in the Ottawa Citizen. In the commentary, Linda Frum described the reasoning for her dour mood over the exhibit. She claimed that among the images in the exhibit were pictures of Abu Iyad, the man responsible for the 1972 Munich Olympic Games Massacre in which 11 Israeli Olympic team members were murdered.

Then she makes a surprising admission. Linda Frum was in Munich on September 5th, 1972 when the attack occurred. That evening, a small group of Canadian athletes returning to the Olympic Village after watching the Canada-Russia hockey series took a short-cut by jumping a chain link fence. Four men joined the athletes climbing the fence into the Olympic village. Those four men turned out to be among the terrorist attackers that would go on to kill 11 Israeli athletes. Linda Frum concedes in her commentary, “I was one of those naive athletes who unwittingly brushed with evil.”

Linda was not alone hanging on the fence. Alan Leibel, on the Olympic sailing team at the Munich games, was also in that small group that encountered the terrorists. Leibel is one of three members of the board of directors at the Grad Foundation (G.F. Foundation), which is listed as another small support donor for Canada-Israel in fiscal 2015. It is important to recall here that Canada-Israel’s year-end is June 30th, and so it is plausible that the donation was made at nearly the same time as the Frum donation. Alan’s donation was also for the exact same amount, $5,000, as Linda’s.

A copy of Danny Eisen’s ad from the June 4th edition of the Ottawa Citizen is included below. There are 15 other non-profit organizations listed as cosigners with C-CAT at the bottom of the ad. Canada-Israel and CIJA are not among them.

Frum is also linked directly to another intermediary, NGO Monitor, used twice by Canada-Israel. On June 16th, 2015 — during one of the two fiscal years that Canada-Israel listed NGO Monitor as an intermediary — Frum joined NGO Monitor’s International Advisory Board.

On its audited financial statements, NGO Monitor describes itself as a public research institute that publicly analyses the activities of NGO’s, especially those working within the international community and in the Palestinian Authority territories and who deal with the Arab-Israeli conflict. The non-profit is founded and today still managed by Dr. Gerald Steinberg.

NGO Monitor’s website has a “Key Issues” section which outlines areas of focus for the non-profit. These include condemning the Bind Sanction Divest (BDS) Movement, fighting lawfare or the “exploitation of legal frameworks and principles used against Israel”, identifying NGOs that use anti-semitic themes, the role of European Governments in funding NGOs critical of Israel’s involvement in the Palestinian Occupied Territories, and identifying medically mandated NGOs that engage in criticism of Israel. It appears fighting on behalf of Israel is in practice central, if not entirely, the mission of this NGO.

NGO Monitor not only connects to Frum, but it also connects directly to former Canadian Foreign Affairs Minister John Baird and to CIJA itself. Highlighted in NGO Monitor’s 2012 Annual Report is a March 2012 reception in Jerusalem organized by the Centre for Israel and Jewish Affairs (CIJA) where NGO Monitor founder Gerald Steinberg was given direct access to Canadian Foreign Affairs Minister John Baird to discuss the role of NGOs in the “demonization” of Israel and the negative effect of the BDS movement on that country. Baird then returned to Israel for a four-day foreign excursion just weeks prior to resigning office in February 2015. Again, Steinberg was given direct access to Baird at a CIJA organized dinner, this time in the relevant fiscal year that NGO Monitor was listed as an intermediary employed by Canada-Israel. A picture was even taken and released by NGO Monitor in its 2015 Annual Report of Baird in conversation with Steinberg.

But even this is of secondary importance. What is most remarkable about NGO Monitor’s use as an intermediary by Canada-Israel is not CIJA or Steinberg’s audience with Baird nor the presence of Frum on the Israeli NGO’s advisory board. It’s the other members of NGO Monitor’s International Advisory Board sitting with Frum. Among these 14 individuals is Fiamma Nirenstein, Richard Kemp and Alexander Downer. All three are also participants of the select “Founder Members” at another intermediary used by Canada-Israel. The most important and prestigious of them all, the Friends of Israel Initiative (“Friends of Israel”).

This relates directly to our target Canadian politicians. John Baird would arrive at the Friends of Israel in September 2015, months after resigning from public service. Stephen Harper would then resign from public service in August 2016. Just ten weeks later, at a Marriot hotel board room in Toronto, the former Prime Minister of Canada would join his friend Baird.

Stephen Harper was certainly a friend of Israel while in office. Such a good friend, in fact, that at the 2013 Negev Dinner held by the Jewish National Fund, it was announced that Stephen Harper would have a bird sanctuary built in Israel in his honour. It would use $5.7 million raised at that very dinner from the 4,000 attendants, the most successful single fundraiser in the Jewish National Fund’s history.

When he stepped up to the microphone to address the assembled diners at JNF Canada CEO Josh Cooper thanked the Co-Chairs the dinner, Linda Frum and Howard Sokolowski, who “made this event happen”.

Gerald Schwartz, Heather Reisman, David Asper, Shimon Fogel, Moshe Ronen, and Albert Friedberg were all in attendance that evening watching Stephen play Beatles tunes up on stage before the assembled crowd.

Israeli Prime Minister Benjamin Netanyahu even delivered a video message at the dinner, warmly regarding the Canadian Prime Minister, a “great friend”.

Unfortunately, the Stephen J. Harper Hula Valley Bird Sanctuary, Visitor and Education Centre fell into intractable scheduling delays and cost overruns by 2018. Linda Frum traveled to Israel herself to attempt to resolve the construction issues and get the Center built.

“We [Linda and Howard] feel a personal responsibility to see the project completed and well executed,” she said.

Couldn’t agree more, Linda Frum.